Is financial anxiety harming your productivity?

Jul 31, 2024

8 mins

Journalist

In an increasingly wealthy world, it might seem that money should be the last thing that workers would have to worry about. Instead, rising prices and interest rates have ensured that even those in well-paid roles can suffer from such financial anxiety that it impacts their productivity.

Falling asleep on the job

The first time David Chesterfield* fell asleep at work, one of his colleagues alerted the boss who had a private word with him. The second time it happened, he was referred to a therapist and signed off work for six weeks with stress. The IT project manager’s financial woes had been keeping him awake at night, but he didn’t think it was affecting his ability to perform his job.

“I thought that I was still being productive. I didn’t realize how my poor sleep was impacting me,” he says. “At work, it felt like I could shut out the stress from my financial issues—that was until I fell asleep without realizing it.”

His troubles began after signing a lease on an apartment only to have his flatmate drop out at the last minute. “I was using my savings each month to pay for things and this started to cause me anxiety as it felt like my future plans were suffering,” he says. “I’d worked hard to save money and now I was burning through it.” This dragged on for months. “I felt agitated and frustrated, but mostly angry with myself.” This affected his social interactions too. “I felt anxious about things like dining out, going out with friends or colleagues because I just didn’t want to spend money,” he adds.

Chesterfield is not alone. More than three-quarters of Americans (77%) report feeling anxious about their financial situation, and 52% feel that finances control their lives. Key stressors reported are keeping up with the cost of living (56%) and managing debt levels (45%).

Household debt levels have surged along with delinquency rates, according to the Federal Reserve. That’s thanks to the Dr. Jekyll and Mr. Hyde economy, says Sidney Curry, co-founder of BC Holdings, a financial wellness educational organization. “Jobs are plentiful, the unemployment rate is low, the inflationary rates are down, but the costs of goods are high and interest rates are up and the housing market is stuck,” he says. “Yet people continue to spend at record levels on travel, entertainment and shopping.”

Curry has first-hand experience of the pain of money worries. When he couldn’t pay his college fees in the 1990s, he dropped out to join the army. On returning from deployment in the Middle East, he found that his automated car payments had not been made correctly and his credit score had tanked. “I didn’t know how to correct this until I met my now wife Saundra [a licensed financial advisor], who not only helped me overhaul my entire financial framework but also showed me what is possible financially if only I had a plan,” he says. The couple later set up BC Holdings to help others achieve financial health too through personal advice and corporate wellbeing programs.

You are not the only one struggling

Financial stress can affect anyone – even those like Chesterfield, who have always been on top of their finances and have savings. The key is to acknowledge that there is a problem. “I started to realize I had been hoping my issue would resolve itself, and I’d become anxious whenever I would check my bank statements and savings accounts,” says Chesterfield. “This made me ignore things even more. Once I was signed off work that gave me breathing space to speak to someone who could help advise me.”

For help, he turned to Alex King, a former banker and founder of Generation Money. King ran a debt management company before setting up Generation Money to guide people in making better financial decisions and building wealth the right way.

Ignoring financial issues is not unusual, according to King, and people are often slow to look for help as they feel guilty, embarrassed, or ashamed. “They talk to me as if they are telling me a secret,” he says. “But there’s nothing to be embarrassed about, especially in today’s economy, as there are so many people who are suffering financially, and we’re just not equipped to understand personal finance.”

Most people have been through similar situations at some point in their lives. “That nagging feeling in the back of their mind [that they need to deal with the problem] often appears just as they are about to go to sleep and keeps them awake at night,” he says. “Thousands, if not millions, of people have gone through this.”

Identifying what changes to make

Unfortunately, most of us don’t have the education, tools, or knowledge to know what to do at such times. “They know they have a problem, they feel ashamed, but they don’t know what to do about it.” That’s why he takes a two-pronged approach, looking at mental health as well as offering advice on practical steps to take. It’s important to help the client understand their behavior, their drivers, how spending makes them feel, and how their debts make them feel. According to King, “When they have that self-awareness, they can start to understand what makes them take certain actions,” says King. That can help them to reset and feel more in control. “Uncertainty is the biggest driver of stress,” he adds.

Once Chesterfield realized that worrying about paying the rent had caused his issues at work, he began to feel better. Then King helped him to put an action plan in place to deal with the practicalities. “Step one, before setting any goals, is to look at their financial situation and that can be pretty daunting, especially when they are already stressed about it, but it’s necessary,” says King.

This highlights what costs are under their control and which are not, such as rent or mortgage payments. Then they can take action by looking at how to cut credit card debt, perhaps by switching their provider or getting a deal on a personal loan. Then, it’s time to examine discretionary spending, such as phone and broadband charges, or a gym membership that is not being used. “Identifying what is within their control often helps them feel better quite quickly and that they are getting on top of things,” says King. “They’re not going to bed thinking ‘I don’t know what to do’ anymore. They’re thinking ‘I have a plan now’ and that makes all the difference.”

It can take weeks or even months for an issue to come to a head. Another client of King’s got into deep credit card debt over a year trying to keep up with his new girlfriend who earned far more money than he did. “Eventually, he told her he was struggling financially and couldn’t afford all the expensive nights out,” he says. “That ended up being a good conversation.”

When stress takes a toll on work

Financial stress manifests differently for everyone, according to Michele Paiva, of The Finance Therapist. For some, like Chesterfield, it might be a constant undercurrent of worry that affects their sleep, focus, and concentration. For others, it can lead to pronounced physical symptoms such as headaches, high blood pressure, or even more severe health issues.

“This stress often trickles down into their professional lives, reducing productivity, increasing absenteeism, and causing a decline in overall job satisfaction,” she says. “In my practice, I’ve seen first-hand how financial anxiety can cripple an individual’s ability to focus and perform at their best. Workers preoccupied with financial worries are often less engaged, less creative, and more prone to errors. This can create a difficult-to-break cycle of stress and underperformance.”

Fear of getting something wrong

Since she was a teenager, Katherine Monge, a doula and photographer, had never felt confident handling money. It stressed her out, leaving her feeling paralyzed. This came to a head after she got married. “I had a lot of anxiety about how the money would come in and how we would deal with [the mortgage and car payments] because I didn’t know,” she says. “I only knew that money came into my account and left just as easily.”

Anxiety made her procrastinate. After buying camera equipment to set herself up as a photographer, Monge was scared to open the box. “It took me a week to open it because I was so afraid,” she says. “I was very afraid to give a price to clients fearing they wouldn’t hire me.” Asking clients to pay for her services was a struggle. “It caused me a lot of anxiety to respond to new clients and send the invoice immediately,” she says. “So, many times I left them unanswered for four days or even a week, which also made me lose clients… All of this led me to feel lost, incapable of maintaining financial stability.”

Through her photography work, Monge met Alejandra Rojas, owner of the Money Mindset Hub, who runs programs on such topics as how to have a better relationship with money. Rojas says that past experiences have a big effect on how we handle money. “I help clients like Katherine by clearing anxiety around money with different techniques,” she says. “The goal is to support the mind in understanding that whatever threatening situation with money happened in the past is no longer happening and that we can create a different future for her.”

Rojas found that Monge had a subconscious belief that she was not good with money due to an incident that happened when she was 15. “As a result, most of her actions, even when she started her business, were based on those unhelpful beliefs,” Rojas says. “Her perspective or mindset couldn’t change until we cleared that traumatic experience and introduced a new way of thinking that led to a new belief and a new way of doing things.”

The process was gradual. “We had a couple of sessions to clear up the traumatic moments she could recall, which were influencing her perspective,” Rojas says. “Immediately afterward, we set up an action plan with specific, beneficial steps aligned with the goals she wanted to accomplish. . . It’s not just about releasing the trauma that generates anxiety but also providing a plan for the next steps so people can return to productivity faster.”

Top tips for dealing with financial anxiety

- Understand that you are not alone and that everyone can be helped—even you. Feeling overwhelmed by money worries happens to people at all income levels and from all backgrounds, according to King. Whatever you do, don’t ignore the issue.

- Take a look at your money mindset. Are you a spender or a saver? How do you feel when you spend money? How do you feel when you save? If you find that you are afraid to even look at your bank account, or that you are constantly checking it, you may need to work on your mindset so that you can deal with the practicalities coldly. “The goal is to support the mind in understanding that whatever threatening situation with money happened in the past is no longer happening,” says Rojas. “You need to expand your beliefs.”

- Assemble all the information you have on your financial situation, including income and expenses, whether fixed or discretionary. As Monge discovered, being happy to spend money on others, but nervous spending on yourself can be a sign that something is not working in your attitude to money. But that can be changed quite quickly. Monge says, “We are only about a month and a half into [Roja’s program] and the change has been radical.”

- Look at how you got to this point. Was it your spending habits? A fixed debt you can’t handle anymore? Do you need to earn more money? Monge says, “It has been very liberating to know that money is not running out, but that it flows. I used to think I had to save money like a treasure because if it ran out, there wouldn’t be more. I’m no longer afraid that I will be left with nothing.”

- Create a plan to pay down debt or increase your income. King points out that a side hustle earning you a few hundred dollars a month could be used to pay off expensive credit card debt if you cannot switch to an interest-free card.

- Consider getting professional help. King points out that many financial advisers will offer a free consultation so you can talk through your issues and then decide whether you need further help. In the past, financial advisers gave advice on practical steps, but now they understand that the whole person needs to be taken into account.

Photo: Welcome to the Jungle

Follow Welcome to the Jungle on Facebook, LinkedIn, and Instagram and subscribe to our newsletter to get our latest articles every week!

More inspiration: Mental health

‘We need each other’: Monika Jiang on combating loneliness in hybrid work

Hybrid work offers flexibility but can leave us feeling disconnected. Monika Jiang explores how we can rebuild workplace connections.

Dec 19, 2024

Struggling at work? Here are 3 steps to rebuilding your self-esteem

Low on confidence? Learn how reflection, recharging, and refocusing can help you rebuild self-esteem and thrive professionally.

Nov 27, 2024

10 ways to beat the Sunday Scaries

Even people who love their jobs can experience the Sunday Scaries. Psychologist Karen Doll offers several strategies to help manage and overcome it.

Sep 12, 2024

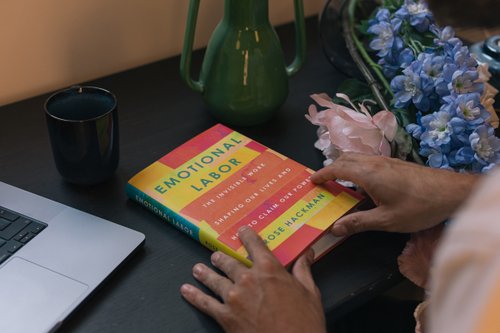

Unpacking the burden of emotional labor

Rose Hackman’s "Emotional Labor" reveals how managing emotions impacts everyone, especially women and minorities.

Aug 08, 2024

How to beat the post-PTO blues

Feeling down after a vacation is normal, but planning ahead and getting back into your routine can help beat those post-trip blues.

Jul 29, 2024

The newsletter that does the job

Want to keep up with the latest articles? Twice a week you can receive stories, jobs, and tips in your inbox.

Looking for your next job?

Over 200,000 people have found a job with Welcome to the Jungle.

Explore jobs